The JPMorgan Guide to Markets is a trusted resource for investors, offering insights into market trends, economic data, and investment strategies through clear charts and expert analysis.

Overview of the Guide

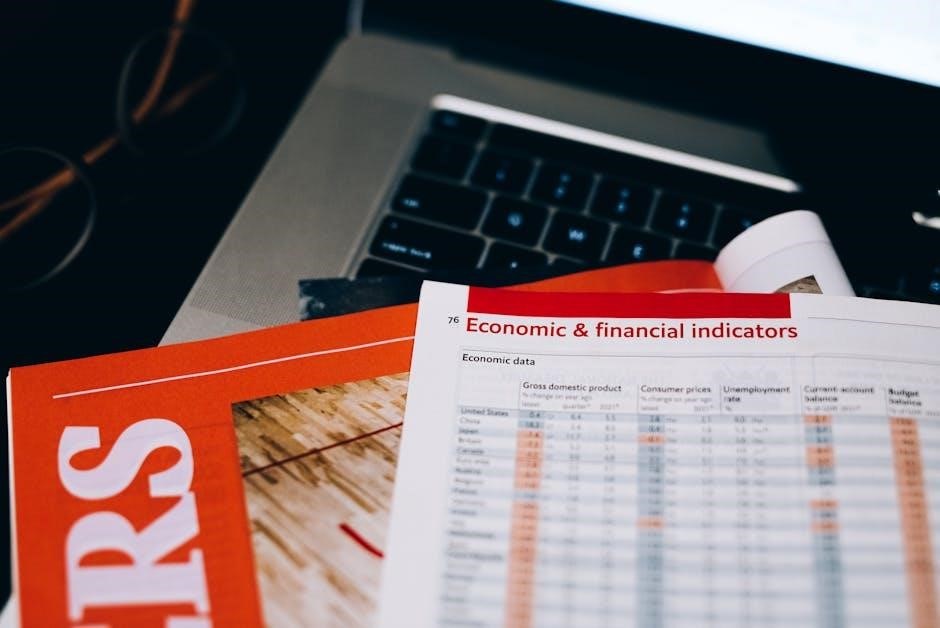

The JPMorgan Guide to Markets provides a comprehensive overview of global market trends, economic indicators, and investment strategies. It is designed to help investors make informed decisions by offering clear and concise insights through charts, infographics, and expert commentary. The guide covers a wide range of topics, including equity and fixed-income markets, inflation trends, employment rates, and risk management strategies. Aimed at both novice and advanced investors, it simplifies complex financial data into accessible visuals and analysis. Regularly updated, the guide reflects current market conditions and emerging trends, making it a valuable resource for staying ahead in the financial landscape. By combining historical data with forward-looking perspectives, the JPMorgan Guide to Markets serves as a trusted tool for understanding market dynamics and shaping investment strategies.

Importance in Financial Markets

The JPMorgan Guide to Markets holds significant importance in financial markets by providing actionable insights and data-driven analysis. It serves as a critical tool for investors, helping them navigate complex market conditions and make informed decisions. The guide’s emphasis on historical trends, current data, and forward-looking perspectives enables investors to anticipate market shifts and capitalize on opportunities. Its comprehensive coverage of global markets, economic indicators, and investment strategies makes it an indispensable resource for both institutional and individual investors. By bridging the gap between data and decision-making, the guide plays a pivotal role in shaping investment strategies and fostering financial literacy. Its reputation as a trusted source underscores its value in the ever-evolving financial landscape, where accurate and timely information is paramount.

Key Features of the Guide

The JPMorgan Guide to Markets offers comprehensive data analytics, interactive visualizations, and expert insights, enabling investors to track market trends and make informed decisions effectively.

The JPMorgan Guide to Markets provides robust data analytics and cutting-edge tools, enabling users to analyze market trends, track economic indicators, and assess investment opportunities with precision. These tools incorporate advanced statistical models and real-time data feeds, offering a comprehensive view of global markets. Investors can access historical data, predictive analytics, and customizable dashboards tailored to their needs. The guide also includes risk assessment modules, allowing users to evaluate potential market risks and develop strategies to mitigate them. By leveraging these tools, users gain actionable insights to make informed investment decisions. The integration of machine learning and AI further enhances the accuracy and relevance of the data presented, ensuring users stay ahead in dynamic financial environments. This suite of tools is designed to support both novice and experienced investors in achieving their financial goals effectively. The JPMorgan Guide to Markets features interactive and visual presentations that simplify complex financial data, making it accessible to a broad audience. Through dynamic charts, infographics, and real-time data visualizations, users can explore market trends, economic indicators, and investment opportunities with clarity. These tools are designed to engage users, enabling them to interact with data in a way that enhances understanding and decision-making. The guide’s visual approach ensures that key insights are presented clearly, allowing investors to quickly identify patterns and opportunities. Whether it’s tracking global market movements or analyzing sector-specific performance, the interactive and visual elements of the guide provide a user-friendly experience. This approach not only simplifies data analysis but also empowers investors to make informed decisions with confidence. The combination of interactivity and visual storytelling makes the guide a powerful resource for both novice and experienced investors. The JPMorgan Guide to Markets provides insights into global and regional market trends, tracking inflation, growth, and capital spending to help investors understand economic shifts and opportunities. The JPMorgan Guide to Markets highlights key global trends, including shifts in inflation, economic growth, and capital spending. It offers insights into how these trends impact various regions and asset classes; By analyzing historical data and current economic indicators, the guide provides a comprehensive view of global market dynamics. Investors can gain a deeper understanding of emerging market opportunities and challenges. The guide also explores the interplay between global events and market performance, helping investors make informed decisions. With a focus on actionable data, it equips readers to navigate complex financial landscapes effectively. The JPMorgan Guide to Markets provides in-depth regional market insights, enabling investors to understand economic and market dynamics across different geographies. It highlights trends in emerging markets, such as Asia-Pacific and Latin America, alongside developed regions like North America and Europe. The guide tracks regional inflation, growth rates, and capital spending, offering a nuanced view of market opportunities and risks. For instance, it explores the rapid growth of digital transformation in Europe and the expansion of emerging markets in Asia. These insights help investors tailor their strategies to specific regions, leveraging local economic conditions and market developments. By focusing on regional disparities, the guide empowers investors to make informed decisions aligned with global and local market realities. This section is essential for those seeking to diversify their portfolios across regions. The section provides insights into key economic indicators, including inflation, GDP growth, and employment rates, using data analytics to track market health and economic stability. Inflation is a critical economic indicator analyzed in the JPMorgan Guide to Markets, as it significantly influences market dynamics and investment decisions. The guide tracks inflation expectations, wage growth, and energy production trends, providing insights into how these factors shape economic stability. Understanding inflation’s impact is vital for investors, as it affects consumer purchasing power, borrowing costs, and overall market performance. The guide highlights historical inflation trends and their correlation with GDP growth, offering a comprehensive view of how inflation influences global and regional markets. By leveraging data analytics, the guide helps investors anticipate inflationary pressures and adjust their strategies to mitigate risks. This section is essential for anyone seeking to navigate the complexities of inflation and its far-reaching implications on financial markets and economic health. Employment rates are a key indicator of economic health, closely monitored in the JPMorgan Guide to Markets. High employment levels often signal a strong economy, boosting consumer spending and corporate earnings. Conversely, low employment rates may indicate economic weakness, impacting market confidence. The guide analyzes employment trends, including wage growth and labor market participation, to assess their implications for global and regional markets. By tracking these metrics, investors can better understand the interplay between employment, economic stability, and market performance. This section provides valuable insights into how employment data influences investment strategies, helping stakeholders make informed decisions. The guide’s comprehensive approach ensures that employment rates are contextualized within broader economic and market dynamics, offering a clear perspective on their role in shaping financial outcomes. The JPMorgan Guide to Markets provides insights into equity and fixed-income strategies, offering a comprehensive view of investment approaches to navigate market dynamics effectively. The JPMorgan Guide to Markets emphasizes equity investment strategies that prioritize fundamental analysis, leveraging financial statements and market trends to identify growth opportunities. By focusing on companies with strong earnings potential relative to GDP, investors can make informed decisions. The guide highlights the importance of sustainability in earnings growth, suggesting that while current trends may not be indefinitely sustainable, strategic investments can yield long-term benefits. Additionally, the guide provides tools and resources to help investors assess risks and align their portfolios with broader economic indicators, ensuring a balanced approach to equity investments. This methodical strategy empowers investors to navigate market dynamics confidently. The JPMorgan Guide to Markets highlights fixed income strategies as a cornerstone of portfolio diversification, emphasizing the importance of understanding market dynamics and economic indicators. By leveraging data analytics and tools, investors can identify opportunities in bonds, treasuries, and other debt instruments. The guide underscores the role of inflation and interest rates in shaping fixed income performance, offering insights into how these factors influence yield curves and credit risks. Additionally, it explores the benefits of diversification across global markets and sectors to mitigate volatility. With a focus on liquidity and risk-adjusted returns, the guide provides actionable strategies for incorporating fixed income investments into a balanced portfolio. This approach enables investors to navigate complex market conditions while aligning with their long-term financial goals. The guide also emphasizes the importance of staying informed about emerging trends and economic shifts to optimize fixed income investments effectively. The JPMorgan Guide to Markets emphasizes strategic risk management to navigate market volatility, ensuring portfolio resilience through diversification and data-driven approaches to mitigate potential losses effectively. Market risk mitigation is a critical component of the JPMorgan Guide to Markets, focusing on strategies to minimize exposure to adverse market conditions. The guide emphasizes the importance of diversification across asset classes, industries, and geographies to reduce concentration risk. It also highlights the use of hedging instruments, such as derivatives, to offset potential losses from currency fluctuations, interest rate changes, or commodity price volatility. JPMorgan’s data analytics tools provide real-time insights into market trends, enabling investors to identify and respond to risks proactively. The guide further underscores the value of stress testing and scenario analysis to assess portfolio resilience under various market scenarios, such as geopolitical crises or economic downturns. By leveraging these strategies, investors can navigate market uncertainties with confidence and achieve more stable returns over time. The guide’s comprehensive approach ensures that market risk mitigation is both practical and effective. Credit risk management is a cornerstone of the JPMorgan Guide to Markets, providing frameworks to assess and mitigate potential defaults or credit-related losses. The guide highlights the importance of thorough credit analysis, leveraging historical data and financial metrics to evaluate issuer credibility. It emphasizes the use of credit ratings, debt-to-equity ratios, and cash flow analysis to identify vulnerabilities. JPMorgan’s tools also incorporate stress testing to gauge portfolio resilience against credit downgrades or defaults. Additionally, the guide advocates for diversification across credit sectors and the use of credit derivatives, such as credit default swaps, to hedge against specific risks. By combining quantitative models with qualitative insights, investors can make informed decisions to optimize their credit exposures and minimize potential losses. This approach ensures a balanced and resilient portfolio, aligning with long-term investment objectives. The JPMorgan Guide to Markets offers practical tools and insights, enabling investors to apply market data and strategies in real-world investment decisions and portfolio management effectively. The JPMorgan Guide to Markets provides actionable insights through real-world case studies, illustrating how investors and businesses leverage its data and analysis for informed decision-making. For instance, the guide details how institutional investors utilized its market trends data to optimize portfolio performance during economic shifts. Additionally, it highlights how corporate strategists employed the guide’s economic indicators to align business expansion plans with global market conditions. These case studies demonstrate the practical application of the guide’s comprehensive insights, offering tangible examples of its value in navigating complex financial landscapes. By focusing on actual scenarios, the guide bridges theoretical analysis with real-world execution, making it an indispensable tool for both seasoned professionals and new investors. The JPMorgan Guide to Markets has empowered investors to achieve remarkable success by providing data-driven insights and strategies. For instance, institutional investors have utilized the guide’s market trend analysis to optimize their portfolios during economic uncertainties. One notable case involves a global investment firm that leveraged the guide’s inflation and employment rate insights to pivot strategies, resulting in significant returns. Individual investors have also benefited, with some achieving long-term growth by aligning their equity and fixed-income investments with the guide’s recommendations. These success stories highlight how the guide’s comprehensive tools and clear presentations enable investors to make informed decisions, fostering financial resilience and growth in dynamic markets. By bridging data with actionable strategies, the JPMorgan Guide to Markets continues to be a cornerstone for investor success worldwide. The JPMorgan Guide to Markets highlights emerging trends, technological advancements, and global economic shifts, offering insights into how markets may evolve and adapt in the future. The JPMorgan Guide to Markets identifies several emerging trends shaping global financial landscapes. These include the rise of digital currencies, increased focus on sustainable investing, and the integration of artificial intelligence in trading strategies. Environmental, Social, and Governance (ESG) factors are becoming critical in investment decisions, influencing portfolio construction and risk assessment. Additionally, the growing importance of emerging markets, particularly in Asia and Africa, presents new opportunities and challenges. Technological advancements, such as blockchain and machine learning, are transforming how markets operate, enhancing efficiency and transparency. These trends underscore the dynamic nature of financial markets, requiring investors to stay informed and adapt to changing conditions. By leveraging data analytics and expert insights, the guide helps investors navigate these evolving landscapes effectively. Technology is revolutionizing financial markets, as highlighted in the JPMorgan Guide to Markets. Artificial intelligence (AI) and machine learning are driving predictive analytics, enabling smarter investment decisions. Blockchain technology is enhancing transparency and security in transactions, while cloud computing provides scalable infrastructure for data management. The rise of algorithmic trading allows for faster execution and optimized portfolios. Furthermore, digital platforms are democratizing access to financial tools, empowering individual investors. These advancements are reshaping market dynamics, creating both opportunities and challenges. The guide emphasizes the importance of embracing technology to stay competitive in this rapidly evolving environment. By leveraging these innovations, investors can achieve greater efficiency and precision in their strategies. The JPMorgan Guide to Markets provides essential insights and strategies for navigating global markets, offering a comprehensive view of economic trends and investment opportunities for investors. The JPMorgan Guide to Markets synthesizes extensive market data, economic indicators, and investment strategies into a cohesive framework. It emphasizes the importance of understanding global and regional trends, highlighting how inflation, employment rates, and geopolitical factors influence market dynamics. The guide underscores the value of data analytics and visual tools in making informed decisions. By focusing on both equity and fixed-income strategies, it provides a balanced approach for diverse investment portfolios. Risk management techniques are also explored, offering practical methods to mitigate market and credit risks. Real-world applications and success stories illustrate the guide’s effectiveness, while its forward-looking perspective on emerging trends and technological advancements ensures relevance in evolving markets. Ultimately, it serves as an indispensable resource for investors seeking to optimize returns and navigate complex financial landscapes effectively. The JPMorgan Guide to Markets is an essential toolkit for investors and financial professionals, offering actionable insights and strategic frameworks. By leveraging its comprehensive data, visual presentations, and expert analysis, users can make informed decisions tailored to their investment goals. The guide’s emphasis on risk management and diversification underscores the importance of a balanced portfolio. As markets evolve, staying informed about emerging trends and technological advancements is crucial. Investors are encouraged to regularly update their strategies and leverage the guide’s practical applications. Whether navigating global trends or optimizing returns, the JPMorgan Guide to Markets remains a cornerstone of financial planning. Its accessible format and depth of analysis make it a valuable resource for both novice and seasoned investors, ensuring they stay competitive in dynamic markets.Data Analytics and Tools

Interactive and Visual Presentations

Market Trends

Global Market Trends

Regional Market Insights

Economic Indicators

Inflation and Its Impact

Employment Rates and Market Health

Investment Strategies

Equity Investment Approaches

Fixed Income Investment Strategies

Risk Management

Market Risk Mitigation

Credit Risk Management

Practical Applications

Case Studies and Real-World Uses

Investor Success Stories

Investor Success Stories

Future Outlook

Emerging Trends in Markets

Technological Impact on Markets

Final Thoughts and Recommendations